Method and Approach to London Rent Guide

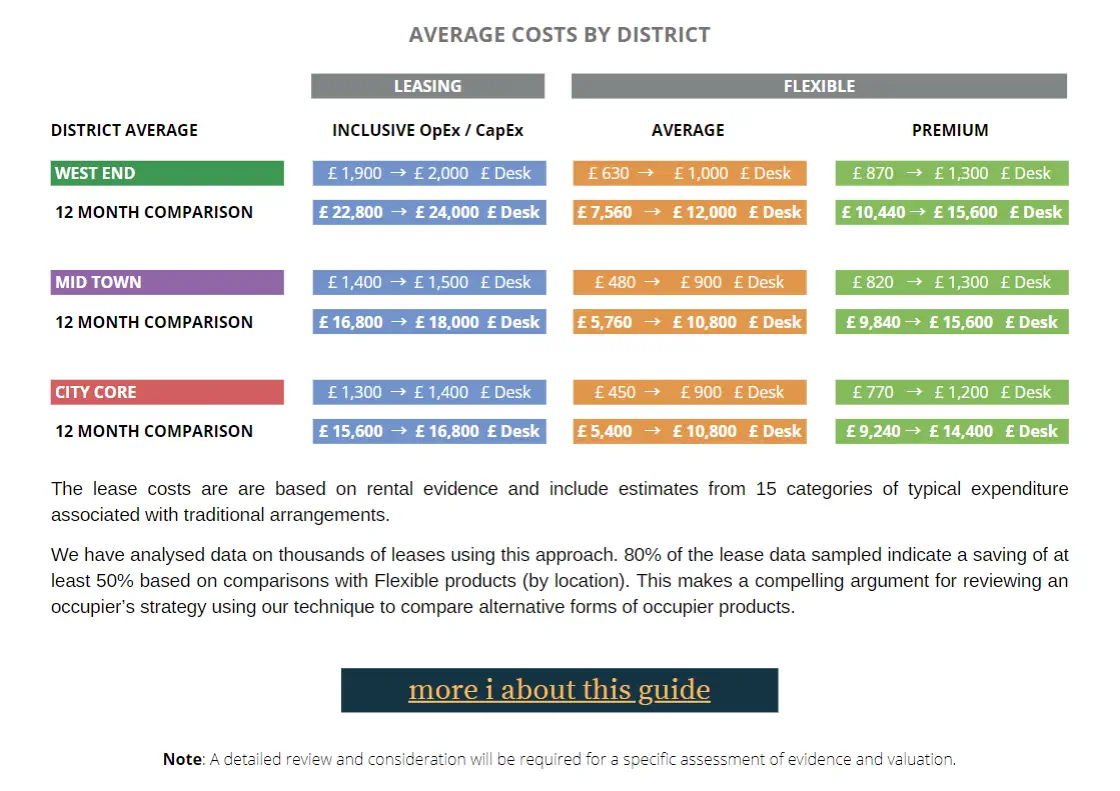

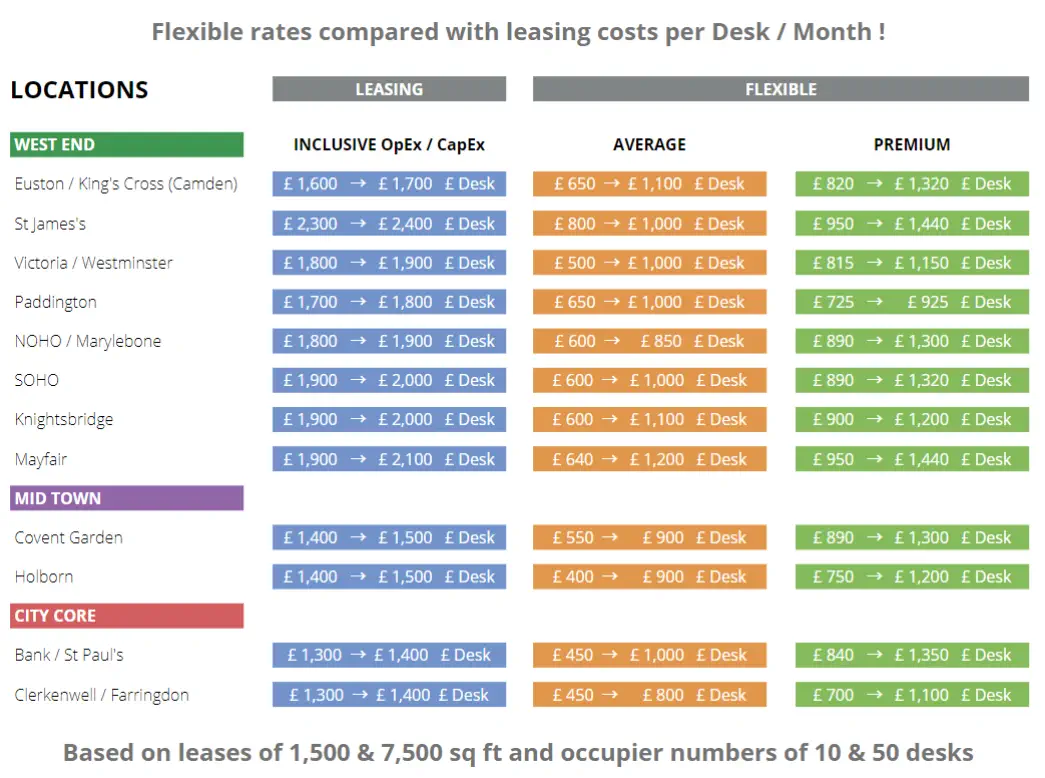

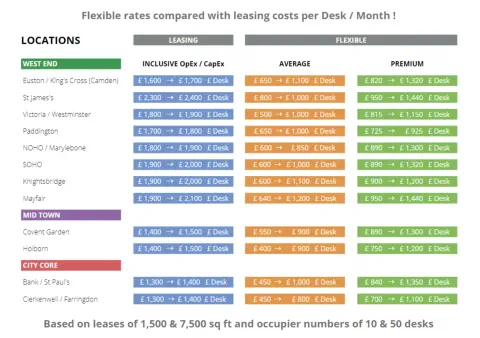

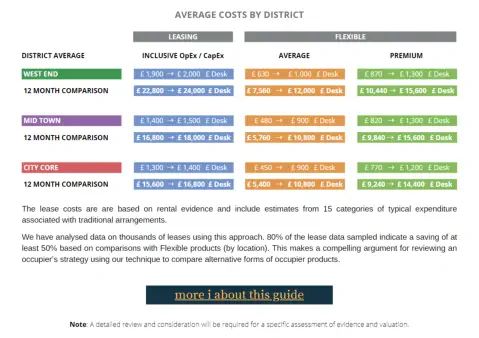

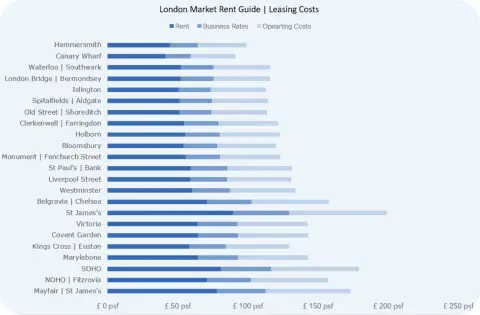

We sampled over 200 data points of rental evidence on leasing that have taken place over the last 18 months to Sep 2020. These are based on average rents for each location and exclude incentives. We covered 12 postal districts in central London and compared them with the rental range for Flexible products, again before incentives. The lease costs are estimated from 15 categories of typical expenditure associated with traditional arrangements. These include estimates for entering into a traditional lease, build-out costs, and operational costs (running and maintaining office space). The estimates are given as a rough guide and are based on published data and market research. Many of the costs are based on service charge analysis and industry benchmarking. Costs are applied on a per square foot basis and also on a per person basis, depending on the method most appropriate for estimating purposes. Flexible operators that provide space-as-a-service charge monthly in advance on an inclusive basis. We use a modified desk metric for leasing to include costs attributed to an average lease term. We then calculate a monthly rate for comparison with Flexible products. These costs are generalised and are indicative of typical expenditure associated with traditional leasing. A better understanding of costs would be gained from a specific review with the occupier on a case by case basis. We have analysed data on thousands of leases using this approach. 80% of the lease data sampled indicate a saving of at least 50% based on comparisons with Flexible products (by location). This makes a compelling argument for reviewing an occupier’s strategy using our technique to compare with alternative forms of occupation. Note: A detailed review and consideration will be required for a specific assessment of evidence and valuation.

OFFICE Solve

Method and

Approach to

London Rent Guide

We sampled over 200 data points of rental evidence on leasing that have taken place over the last 18 months to Sep 2020. These are based on average rents for each location and exclude incentives. We covered 12 postal districts in central London and compared them with the rental range for Flexible products, again before incentives. The lease costs are estimated from 15 categories of typical expenditure associated with traditional arrangements. These include estimates for entering into a traditional lease, build-out costs, and operational costs (running and maintaining office space). The estimates are given as a rough guide and are based on published data and market research. Many of the costs are based on service charge analysis and industry benchmarking. Costs are applied on a per square foot basis and also on a per person basis, depending on the method most appropriate for estimating purposes. Flexible operators that provide space-as-a-service charge monthly in advance on an inclusive basis. We use a modified desk metric for leasing to include costs attributed to an average lease term. We then calculate a monthly rate for comparison with Flexible products. These costs are generalised and are indicative of typical expenditure associated with traditional leasing. A better understanding of costs would be gained from a specific review with the occupier on a case by case basis. We have analysed data on thousands of leases using this approach. 80% of the lease data sampled indicate a saving of at least 50% based on comparisons with Flexible products (by location). This makes a compelling argument for reviewing an occupier’s strategy using our technique to compare with alternative forms of occupation. Note: A detailed review and consideration will be required for a specific assessment of evidence and valuation.

OFFICE Solve